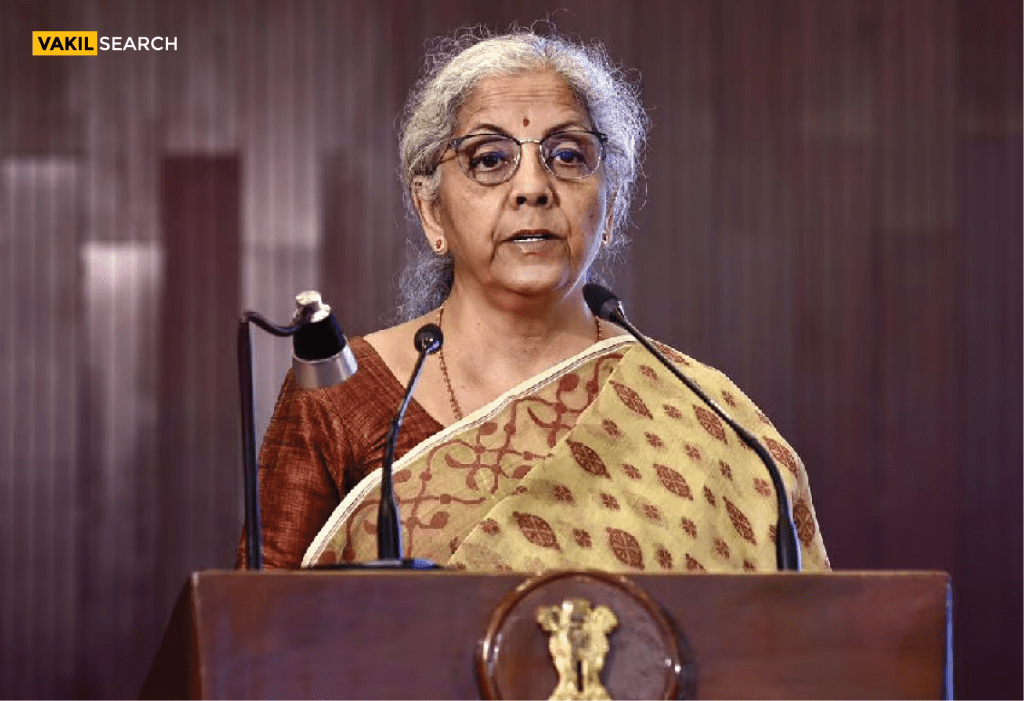

Finance Minister Nirmala Sitharaman addressed concerns on Monday in the Lok Sabha regarding India’s rising gold reserves, stressing that these increases, including those held by the Reserve Bank of India (RBI), are not an attempt to replace the US dollar in international trade settlements.

Gold Reserves and the US Dollar Debate

The issue arose when Congress MP Manish Tiwari questioned whether a global trend towards increasing gold holdings signalled a move away from the US dollar as the dominant currency for trade. Tiwari pointed out that since the US left the gold standard in 1971, gold’s role as a key financial asset had diminished. However, central banks in countries like China, India, Poland, and Turkey have been ramping up their gold reserves in recent years.

Gold now makes up around 11% of global reserves, compared to just 6% in 2006. In India, rising gold prices and the RBI’s purchases have drawn attention, prompting Tiwari to ask whether this shift indicates that nations are looking for an alternative to the US dollar for global trade settlements.

Minister’s Response: Gold as a Safe Investment

In response, Sitharaman acknowledged the strong demand for gold in India but made it clear that this was largely driven by cultural preferences rather than a strategic shift away from the US dollar. “It is typical of Indian households, small businesses, and women to invest in gold. People see it as secure and liquid,” Sitharaman explained. She pointed out that for many, especially in India, gold has always been a preferred form of investment due to its perceived safety.

RBI’s Strategy to Diversify Reserves

Regarding the RBI’s increased gold purchases, Sitharaman explained that the central bank’s objective is to diversify India’s foreign exchange reserves. While the US dollar has traditionally been the backbone of India’s reserve portfolio, the RBI holds a variety of currencies and gold. This strategy aims to maintain a balanced and stable reserve system, which is less vulnerable to fluctuations in any single asset.

She emphasized that the country’s growing gold reserves are not part of a larger plan to challenge the US dollar’s dominance in global trade. “Our gold purchases are part of a broader strategy to diversify our reserves and ensure their resilience,” Sitharaman stated. “This is not an attempt to move away from the dollar or replace it with gold.”

Global Context: De-dollarisation and Rising Gold Reserves

Sitharaman’s statement comes amid growing international discussions on de-dollarization. Several countries, particularly in the developing world, have voiced concerns about the dominance of the US dollar in global trade. In response, some have started seeking alternatives, including using other currencies or increasing gold reserves. Despite this, the US dollar remains the most widely used currency for international trade and reserve holdings.

India’s decision to accumulate more gold is aligned with global trends, but the Finance Minister made it clear that the country’s approach is not a response to a desire to replace the dollar. “Gold continues to play an important role in global reserves, but it does not signal a shift in India’s stance towards the US dollar,” Sitharaman said.

Gold Prices in India and RBI’s Purchases

India has always had a deep connection with gold. Many households, small businesses, and women see it as a safe, tangible investment. The surge in domestic gold prices has paralleled the global trend of increased gold reserves, yet Sitharaman emphasized that India’s gold purchases reflect cultural and economic factors unique to the country. While India remains a major player in the global gold market, its central bank’s strategy is to ensure a diversified, stable, and resilient reserve portfolio.

Clarifying the Strategy: No Push for Alternative Currencies

Sitharaman was quick to clarify that the increasing gold reserves in India should not be misinterpreted as part of a broader push for alternative currencies or a move away from the US dollar. “The growing gold reserves in our portfolio are simply a part of our effort to maintain a balanced foreign exchange reserve system,” she said. “We are not moving away from the dollar or seeking an alternative settlement mechanism.”

While global discussions on alternatives to the US dollar persist, India’s position remains focused on strengthening its economic resilience through a diversified reserve strategy. Despite some countries’ growing interest in reducing their reliance on the US dollar, Sitharaman reiterated that India’s actions reflect a desire for balanced financial security, not an ideological shift away from the US dollar.

India’s Gold Reserves: A Long-Term Strategy

India’s growing gold reserves come amid the country’s broader financial strategy to ensure its long-term economic stability. As the RBI continues to increase its gold holdings, the move represents a prudent effort to secure India’s financial future by diversifying assets. Gold, being a stable and liquid asset, is seen as an important component of a well-rounded financial portfolio, especially in the face of global economic uncertainty.

Sitharaman’s statements put to rest speculation that India’s gold buying reflects a desire to challenge the US dollar’s role in global financial systems. The Finance Minister made it clear that India’s commitment to the US dollar as a global settlement mechanism remains unchanged. Instead, the country’s focus is on strengthening its foreign exchange reserves by ensuring that they are diverse and resilient to external shocks.

As global financial strategies change, businesses need to stay updated and compliant. Vakilsearch provides legal and tax services to help you stay on track.

- India’s Gold Reserves Growth Not Aimed at Replacing US Dollar: FM - February 11, 2025

- Swiggy Instamart Glitch: Users Got ₹5 Lakh Free Cash, Stock Drops 5% - February 10, 2025

- Zomato Rebrands to Eternal; Netizens React Strongly - February 7, 2025