The Adani Group has reported a significant increase in its tax contributions, paying Rs 58,104 crore in the financial year 2023-24. This marks a 25% rise from the Rs 46,610 crore paid in the previous year. The information was disclosed through the group’s Tax Transparency Report, a voluntary initiative aimed at promoting transparency in corporate tax practices.

The conglomerate, which operates across sectors including energy, infrastructure, and media, stated that its tax contributions encompass direct taxes, duties, and charges borne by its portfolio companies. The figure also includes indirect tax contributions, duties collected and paid on behalf of stakeholders, and social security contributions for employees.

Breakdown of Tax Contributions

The tax contributions come from seven key listed entities within the Adani Group:

- Adani Enterprises Limited

- Adani Ports and Special Economic Zone Limited

- Adani Green Energy Limited

- Adani Energy Solutions Limited

- Adani Power Limited

- Adani Total Gas Limited

- Ambuja Cements Limited

Additionally, the tax figures include contributions from NDTV, ACC, and Sanghi Industries, which are subsidiaries of the group’s listed entities.

Commitment to Transparency

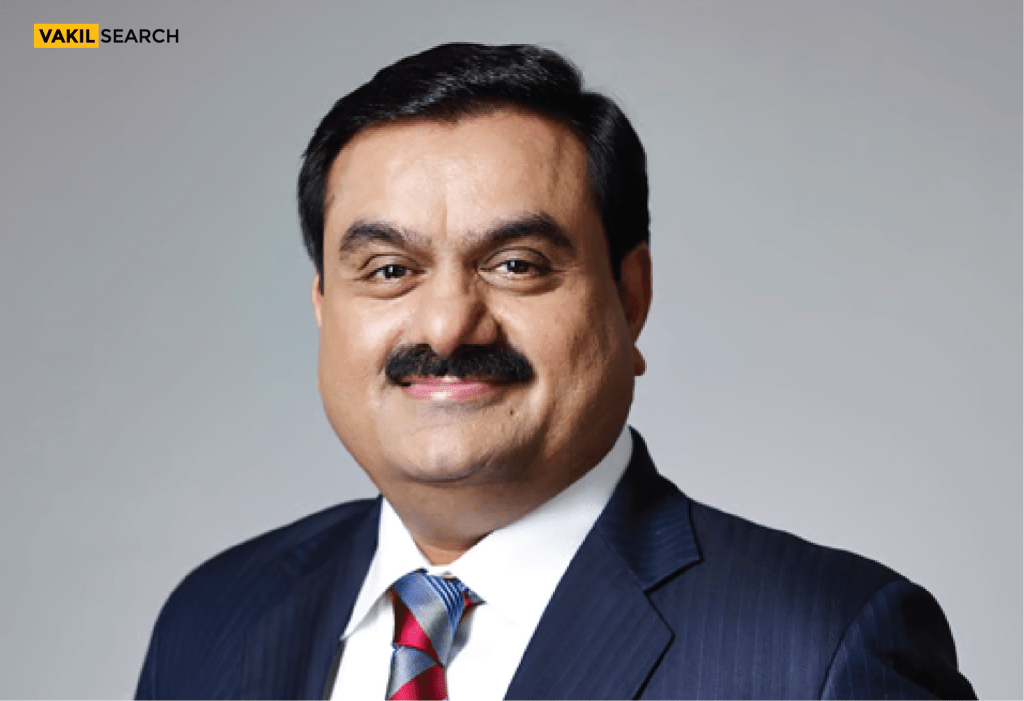

Adani Group Chairman Gautam Adani emphasised the company’s commitment to transparency and accountability in a statement.

“As one of India’s largest contributors to the exchequer, we recognise that our responsibility goes beyond compliance. It is also about operating with integrity and accountability. Every rupee we contribute to our nation’s finances reflects our commitment to transparency and good governance. By voluntarily sharing these reports with the public, we aim to foster greater stakeholder confidence and set new benchmarks for responsible corporate conduct,” Adani said.

The group stated that it considers tax transparency an essential component of its Environmental, Social, and Governance (ESG) framework. The Tax Transparency Report details how the group’s tax practices align with its broader goal of sustainable and responsible business growth.

Independent Assurance and Global Tax Environment

To enhance credibility, the Adani Group engaged a professional agency to provide an independent assurance report on its tax contributions. The report outlines the group’s total contributions to government revenues, ensuring accuracy and compliance with tax regulations.

The group highlighted that voluntary tax transparency initiatives are becoming more common in the global business environment. Companies are increasingly opting to disclose detailed tax reports, even when not mandated, to build trust with stakeholders and regulators.

“By voluntarily disclosing information about our global tax contributions, we strengthen our commitment to economic development, foster stakeholder understanding, and build trust through transparent tax practices,” the company said in a media statement.

Impact on Economic Development

The Adani Group’s tax contributions play a crucial role in supporting government revenues and public expenditure. The increase in tax payments reflects the group’s growing business operations and financial performance over the past year.

The Tax Transparency Report categorises tax contributions into three main areas:

- Direct contributions: Taxes, duties, and charges directly borne by Adani’s listed companies.

- Indirect contributions: Taxes and duties collected from stakeholders and remitted to authorities.

- Other contributions: Social security contributions for employee benefits.

As one of India’s leading corporate taxpayers, the Adani Group’s disclosures aim to enhance corporate governance standards and reinforce its position as a responsible business entity. The company asserts that these efforts contribute to a more accountable global tax environment and set benchmarks for tax transparency in India’s corporate sector.

The release of the Tax Transparency Report comes as businesses worldwide face increasing scrutiny over tax practices. By proactively sharing its tax data, the Adani Group aims to demonstrate its commitment to regulatory compliance and ethical corporate governance.

Vakilsearch offers expert assistance in tax compliance and legal filings to keep your business compliant.

- Adani Group’s Tax Contribution Rises 25% to Rs.58,104 Cr in FY24 - February 24, 2025

- Green Loans Boost Indian Banks’ Stability: IIM Study - February 21, 2025

- Punjab Expands GST Base with Targeted Drives & Digital Tools - February 20, 2025