Introduction: Byju’s Insolvency Directors Challenge NCLT Ruling

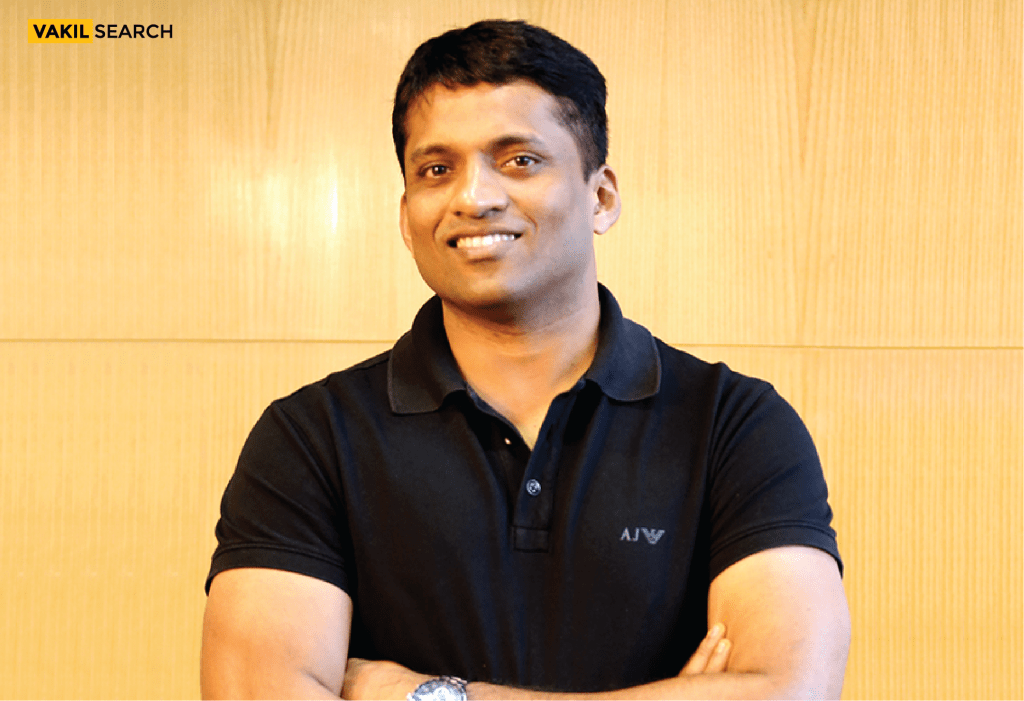

The legal battle over Byju’s insolvency continues to unfold as the suspended directors, including Riju Raveendran, move the National Company Law Appellate Tribunal (NCLAT) to challenge the NCLT ruling that reinstated the company’s lenders as financial creditors. This challenge comes amid an unresolved dispute over ₹158 crore owed to the Board of Control for Cricket in India (BCCI). The outcome of this legal battle is crucial as it could determine whether Byju Raveendran, the founder of Byju’s, can regain control of the company.

Key Developments in the Byju’s Insolvency Case: Directors Challenge NCLT Ruling

Directors Move NCLAT: Challenging NCLT Ruling on Financial Creditors

The suspended directors and the company’s current resolution professional, Pankaj Srivastava, have approached NCLAT in Chennai, challenging the NCLT ruling from January 29, 2025, which reinstated Byju’s lenders as financial creditors. The decision has left the dispute over the ₹158 crore owed to BCCI unresolved. Reinstating the lenders could prevent the founders from regaining control of the company, which is still undergoing insolvency proceedings.

Importance of the ₹158 Crore Settlement:

The heart of the dispute is Byju’s ₹158 crore settlement with BCCI, meant to clear outstanding dues under a jersey sponsorship deal. If the NCLT had approved this settlement, Byju’s could have exited insolvency, restoring control to its founders, especially Byju Raveendran. However, the tribunal did not resolve the issue, keeping the insolvency process active.

Reinstating Creditors and Management Challenges:

The Committee of Creditors (CoC), which is overseeing Byju’s insolvency, is controlled by Glas Trust. It holds 99.41% of the voting share due to a claim of ₹11,432 crore. Other creditors, like Aditya Birla Finance and Incred Financial Services, hold smaller stakes. The suspended directors argue that the tribunal’s decision, including the replacement of the current resolution professional and the reinstatement of the CoC, reflects a possible “nexus” that harms the company’s interests.

The NCLT and BCCI Angle:

Insolvency proceedings began against Byju’s on 16 June 2024 after the company defaulted on the ₹158 crore payment to BCCI. Byju’s entered the agreement with BCCI in 2019 for jersey sponsorship rights for the Indian cricket team. However, the company failed to meet its financial obligations, prompting BCCI to seek insolvency. Both Byju’s and BCCI later sought approval for a settlement, but the NCLT has yet to issue an order, forcing Byju’s to escalate the matter to NCLAT.

Previous Legal Outcomes:

Earlier, the Supreme Court quashed a previous settlement between Byju’s and BCCI on 23 October 2024. The Court ruled that the settlement process did not follow proper procedure under the Insolvency and Bankruptcy Code (IBC). The Court directed both parties to return to the NCLT for fresh proceedings. In August 2024, the NCLAT dismissed the insolvency case and approved the BCCI settlement after Riju Raveendran raised ₹158 crore to clear the dues. This temporarily restored his family’s control over Byju’s operations.

Contested Settlement and Financial Scrutiny:

However, Glas Trust challenged the settlement, claiming that the funds raised for it were “tainted” and should be allocated to Byju’s financial creditors. Glas Trust also highlighted ongoing investigations by the Enforcement Directorate into Byju’s financial dealings. These complications have delayed the finalization of the settlement and the exit from insolvency.

The Impact on Byju’s and Its Future:

Byju’s remains in insolvency proceedings, with Glas Trust controlling a significant portion of the company’s voting power. The Raveendran family is locked out of control, and Byju Raveendran, currently residing in Dubai, faces an uncertain future for his company. The next steps in this legal battle could determine whether the founders can regain control of their once-celebrated edtech giant.

Conclusion:

The ongoing legal battle surrounding Byju’s highlights the complexities of corporate governance and financial disputes within the edtech industry. As the company navigates insolvency proceedings and faces challenges from both creditors and regulatory authorities, the fate of its founders remains uncertain. The outcome of the case will not only determine Byju Raveendran’s potential return to control but also set a precedent for similar disputes in India’s rapidly growing edtech sector. With multiple legal hurdles still ahead, the resolution of this case will significantly shape the future of Byju’s and its place in the industry.

For more Updates like this , Visit VAKIL SEARCH !

- Alkem Laboratories Faces ₹62 Crore GST Demand - February 28, 2025

- Bombay High Court to Rule on VW’s Time-Barred Customs Duty Demand - February 27, 2025

- SMA Treatment Funding in India: Supreme Court Stays Order - February 26, 2025