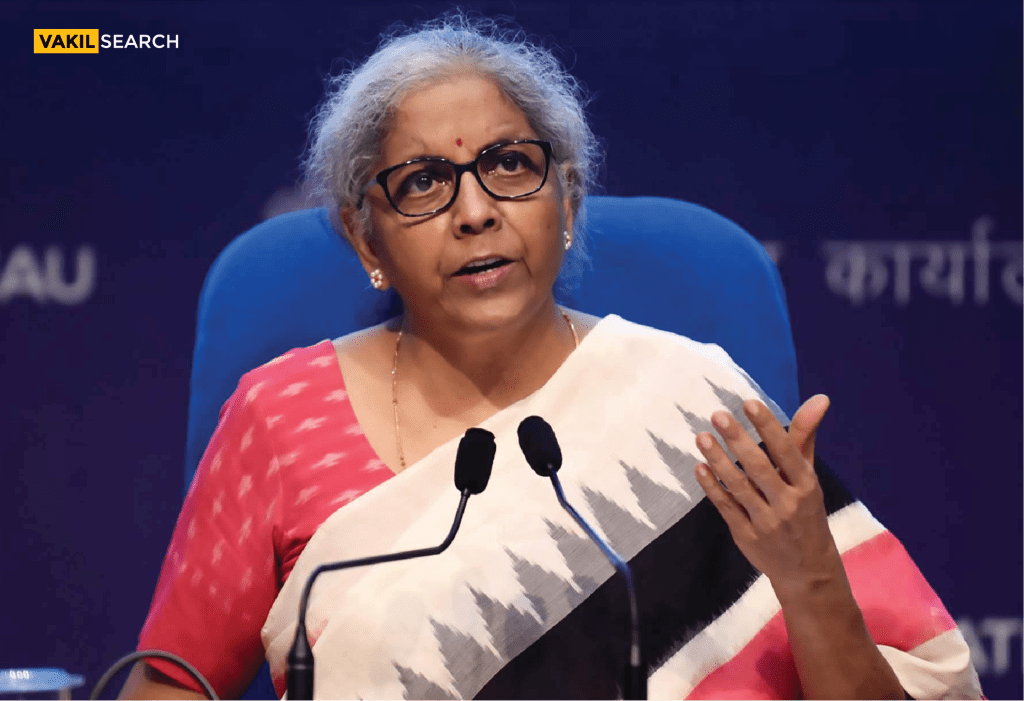

Union Finance Minister Nirmala Sitharaman said on Saturday that the Goods and Services Tax (GST) Council is finalising its review of the existing tax structure and will soon decide on reducing GST rates. Speaking at the Economic Times Awards for Corporate Excellence in Mumbai, she stated that the ministerial group assigned to the task had made significant progress and would present the matter before the Council for a final decision.

Final Stages of Tax Review

Sitharaman confirmed that the GST rationalisation process, which includes restructuring tax slabs and lowering rates, is nearing completion. “We are very close to taking a final call on key issues, including rate reductions and the number of slabs,” she said. She added that GST rates have steadily decreased since the tax was implemented in 2017.

At the time of GST’s introduction, the revenue-neutral rate was around 15.8%, but this has since declined to 11.4% as of 2023. “This indicates that tax rates have come down, and they will reduce further,” Sitharaman said, hinting at upcoming changes.

The GST Council, chaired by the Union Finance Minister and composed of state ministers, is responsible for making decisions on GST rates and structures. The Council’s next meeting is expected to address the proposed revisions.

Private Sector Investment and Economic Growth

Sitharaman also addressed concerns regarding private sector investment, stating that current investments remain concentrated in a few sectors. She urged industries to communicate their investment plans with the government, highlighting that India’s economy continues to grow at 6.5-7% post-pandemic, making it the fastest-growing major economy.

The Finance Minister noted that market sentiment and confidence influence economic growth. “If market sentiments impact our stock markets, the same logic applies to the economy. A strong belief in India’s potential can drive higher growth,” she said, adding that a sentiment-driven approach could help push India’s growth rate beyond 8%.

Capital Gains Tax and Market Sentiment

On the issue of foreign institutional investors reducing their holdings in Indian markets due to capital gains tax concerns, Sitharaman declined to comment, citing the ongoing Parliament session. The Budget session, set to resume on 10 March, will likely discuss the recent capital gains tax hike from 10% to 12.5%, introduced in the July 2024 Budget.

Trade Agreements and Dumping Concerns

Sitharaman highlighted challenges in India’s trade policies, particularly regarding Free Trade Agreements (FTAs). She acknowledged that negotiators rushed some past FTAs, allowing unregulated inflows of foreign goods. The Commerce Ministry is now reviewing trade agreements with key partners, including Japan, South Korea, and the ASEAN nations.

“There is an influx of goods entering India without sufficient regulation. Duties do not impact them due to FTAs,” she said. She emphasised that future trade agreements would prioritise India’s interests, ensuring fair terms and preventing economic disadvantages.

Addressing concerns about the dumping of cheap goods, Sitharaman stressed that while protecting domestic manufacturers is essential, affordable imports also benefit small businesses. She stated that the government would take a balanced approach, incorporating input from all stakeholders before taking action against dumped goods.

Regulatory Coordination and Banking Sector

Sitharaman ruled out the need for a permanent regulatory oversight body but stressed the importance of streamlining regulations to prevent confusion among businesses. She noted that the government remains committed to reducing its stake in public sector banks to encourage greater participation from retail investors.

Additionally, she acknowledged past concerns over non-banking financial companies (NBFCs) and microfinance institutions engaging in aggressive lending practices. She credited the Reserve Bank of India (RBI) for stabilising the sector and said recent regulatory relaxations improved lending conditions.

India’s Economic Outlook

Looking ahead, Sitharaman expressed confidence in India’s growth trajectory, urging businesses and investors to adopt a forward-looking approach. “India remains the fastest-growing major economy despite global uncertainties. We must focus on the opportunities ahead rather than being constrained by past challenges,” she said.

As India navigates global economic shifts and trade uncertainties, the government is focusing on tax rationalisation, trade policy revisions, and regulatory reforms to strengthen the country’s economic position. The Council will clarify GST rate adjustments in its upcoming meeting, impacting businesses and consumers alike.

Ensure seamless GST compliance with Vakilsearch’s expert assistance. Get accurate filing and professional support for your business.

- GST Rates May Drop Soon as Council Reviews Tax Structure - March 10, 2025

- Foreign Assets Worth ₹29,000 Cr Declared After ITD Campaign - March 7, 2025

- RBL Bank Shares Drop as GST Authorities Conduct Search - March 4, 2025