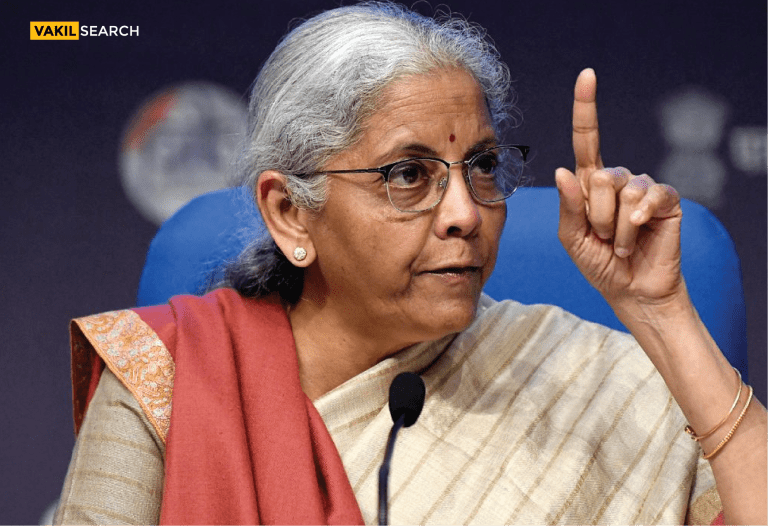

The Expenditure Secretary, Manoj Govil, clarified that the Pay Commission’s financial implications would not be felt in FY26, but would come into effect in the following fiscal year. The Union Budget 2025-26 introduces a series of strategic financial measures, including a provision of ₹7,000 crore for the Unified Pension Scheme (UPS). Here are the key highlights from the interview of the Expenditure Secretary with a leading news portal, shedding light on future government financial decisions.

Pay Commission in FY26: No Immediate Impact

The formation of the Eighth Pay Commission has sparked significant discussions regarding its financial impact on the government’s budget. However, in an interview with Business Today, Manoj Govil emphasised that there would be no immediate financial burden of the Pay Commission on the 2025-26 budget. The Expenditure Secretary confirmed that the financial impact of the Pay Commission would only be felt starting in the subsequent fiscal year.

Setting Up the Eighth Pay Commission: Next Steps

Govil provided insights into the steps being taken to establish the Eighth Pay Commission. The Department of Expenditure has initiated discussions with key ministries, including Defence, Home Affairs, and the Department of Personnel and Training, for their suggestions on the terms of reference. While the pay commission’s recommendations apply only to the central government, many state governments choose to adopt them.

Once feedback from these departments is collected, the government will finalise the terms of reference and decide on the composition of the commission. Following that, a formal notification will be issued, and the commission will begin its work. Historical precedent suggests that the commission may take over 12 months to provide its recommendations.

Financial Impact of the Unified Pension Scheme (UPS)

One of the major financial decisions in the Union Budget 2025-26 is the Unified Pension Scheme (UPS), which is slated to begin on 1 April 2025. According to Manoj Govil, the implementation of this scheme will have a fiscal impact of approximately ₹7,000 crore. This amount, allocated in the budget, will cover the additional 4.5% contribution from the government and liabilities related to pension arrears.

UPS Implementation: Addressing Future Liabilities

The Unified Pension Scheme will offer central government employees the choice between staying under the National Pension System (NPS) or shifting to the UPS. Govil expressed optimism about the scheme’s appeal, highlighting the guaranteed payout, family pension, and minimum pension of ₹10,000 as attractive features for employees.

Despite past concerns that the guaranteed pension could increase government liabilities, the UPS is designed to be self-sustaining. The Expenditure Secretary also stated that the government would closely monitor the scheme’s progress over the next few years to ensure that the corpus and investment returns are on track to meet the payouts without burdening the Consolidated Fund of India.

Financial Outlook for FY26 and Beyond

In terms of the broader fiscal outlook, Manoj Govil confirmed that the 16th Finance Commission’s recommendations will be submitted by October 2025, with their provisions taking effect from 1 April 2026. However, these recommendations will have no direct impact on the Union Budget for FY26.

While the Eighth Pay Commission will not affect government finances in FY26, future years will see adjustments once its recommendations are implemented. The Unified Pension Scheme, on the other hand, is set to have a more immediate impact in the coming fiscal year, with significant provisions already made in the budget.

Conclusion: Focus on Fiscal Sustainability

The Expenditure Secretary stressed that while the Eighth Pay Commission and the Unified Pension Scheme will have long-term financial implications, the government’s efforts are focused on ensuring fiscal sustainability. The budget provisions for FY26 are set with careful planning to mitigate the impact of these schemes on future generations.

By prioritising the formation of the UPS corpus and monitoring its returns, the government aims to ensure that the scheme’s benefits are self-sustained, with no undue strain on public finances. For more clarity on personal finance and taxes talk to a CA from Vakilsearch today. We have a team of experts who can help you in ITR filing and financial planning.