The Maharashtra government is grappling with a record debt burden of ₹9.32 lakh crore for the financial year 2025-26, the highest in the state’s history. At the same time, it is owed ₹1.66 lakh crore in unrealised tax and non-tax revenue. This unpaid amount represents over 22% of Maharashtra budget, creating significant financial pressure on the government.

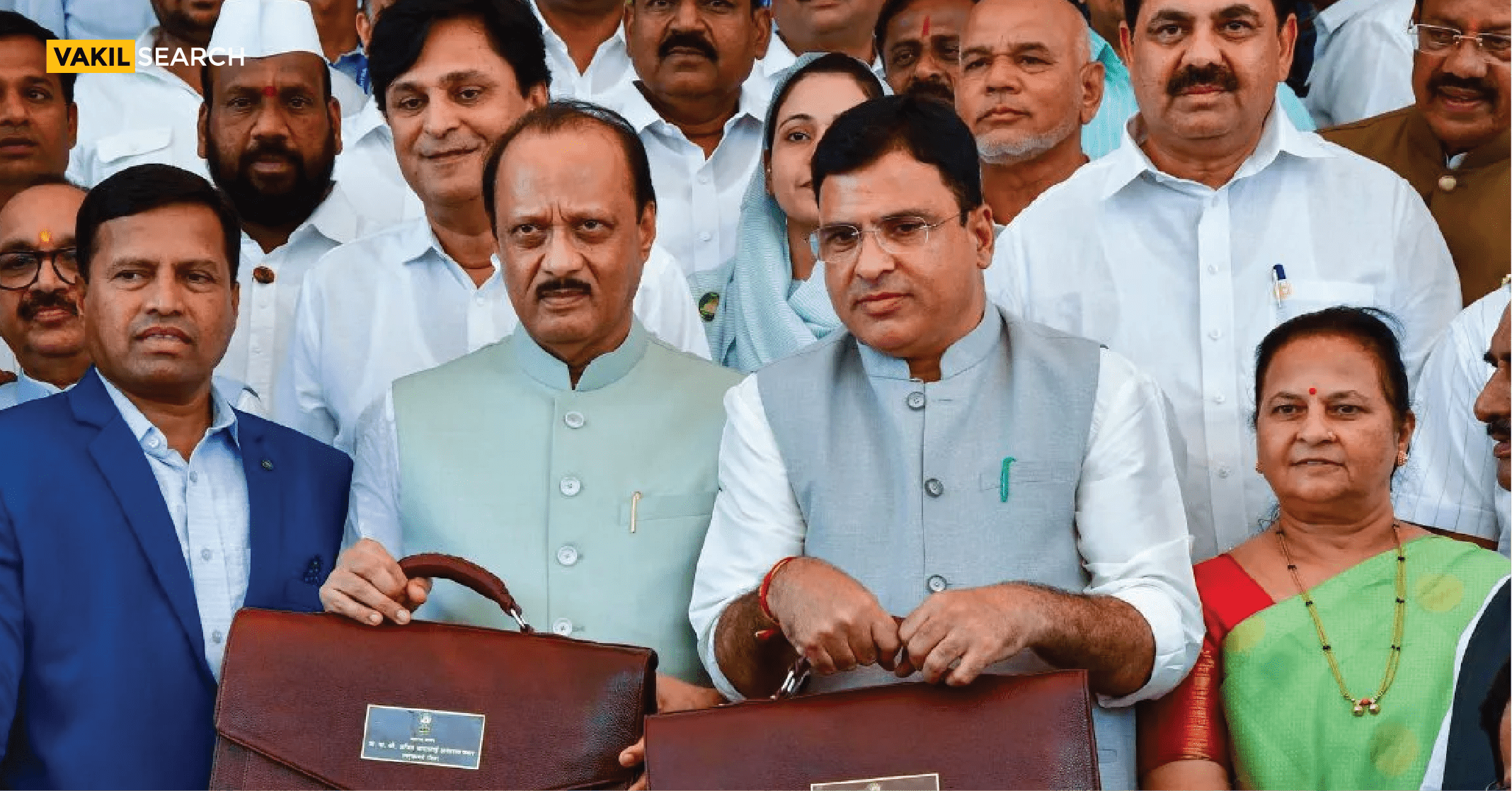

While presenting Maharashtra budget for FY 2025-26 on Monday, Finance Minister Ajit Pawar announced an amnesty scheme aimed at recovering pending arrears. The government hopes to generate approximately ₹8,000 crore through this scheme. A significant portion of the unrealised tax revenue comes from tax disputes involving central government departments and oil marketing companies.

Massive Tax Revenue Arrears and Disputes

Despite the government’s efforts, even if the entire ₹8,000 crore is successfully recovered, it would still account for just 5.5% of the total unrealised revenue from various taxes, which currently stands at ₹1.43 lakh crore. Furthermore, the amnesty scheme does not extend to non-tax revenue arrears, which amount to ₹22,746 crore.

Of the total ₹1.43 lakh crore in tax revenue arrears, a substantial portion of ₹94,526 crore comes from long-standing disputed cases. These disputes, many of which have been pending for years, involve complex legal and administrative challenges. The most significant component of these disputes is ₹66,411 crore from sales tax and value-added tax (VAT) on motor spirits and lubricants, which predates the implementation of the Goods and Services Tax (GST) in 2017.

The second-largest disputed amount involves central taxes, totalling ₹21,519 crore. Additionally, the GST Commissionerate has struggled to recover ₹48,534 crore, despite these dues not being contested. Other major outstanding amounts include ₹37,859 crore from central taxes and sales tax/VAT on motor spirits and lubricants.

Challenges in Recovery and Amnesty Scheme Implementation

An official from the GST Commissionerate highlighted the persistent challenges in recovering disputed tax arrears. Many of these disputes are entangled in prolonged litigation at various levels, including the courts. The amnesty scheme is expected to cover cases that have been stuck in legal proceedings, although the fine details of the scheme are yet to be finalised and notified.

‘We have been offering companies waivers of up to 80% of outstanding arrears if they agree to pay the remaining 20%. This means that penalties and interest are waived, which has helped reduce outstanding amounts in disputed cases by nearly half over the past four years. However, the remaining cases are complex and difficult to resolve, even after implementing multiple amnesty schemes,’ the official explained.

The disputes primarily stem from differences in tax interpretations, where companies contest the levied taxes based on varying legal grounds. Some disputes arise due to restrictions on exports and international trade, where the government disallowed tax benefits. This further complicates the full recovery of the outstanding amounts.

‘It would be inaccurate to assume that the entire outstanding amount can be recovered since some cases involve genuine disputes over tax applicability,’ the official added.

Moreover, non-disputed tax arrears will not be eligible for the amnesty scheme. In such cases, companies have already collected the amount from third parties and are legally required to pay it to the government.

Non-Tax Revenue Arrears: A Significant Concern For Maharashtra Budget

In addition to tax arrears, the Maharashtra government is struggling with a backlog of ₹22,746 crore in non-tax revenue. The largest portion of this, ₹19,183 crore, is owed by various state government departments, including those related to cooperation, textiles, irrigation, and power.

The state police and jail departments also contribute to the arrears. A significant portion of their outstanding dues stems from uncollected traffic violation fines. ‘The non-tax revenue is pending due to multiple reasons, including procedural delays and financial constraints within government departments,’ said an official from the state Finance Department. The amnesty scheme does not apply to non-tax revenues, making recovery even more challenging.

Implications for Maharashtra Budget and the State’s Financial Health

The Maharashtra government’s record debt of ₹9.32 lakh crore continues to be a pressing concern, especially given its struggle to recover outstanding revenues. While the amnesty scheme may provide some relief, the overall impact will be limited unless substantial progress is made in resolving long-standing disputes.

The state government relies heavily on tax revenue to fund infrastructure projects, public services, and welfare programs. Failure to recover these arrears could lead to budgetary constraints, affecting key developmental initiatives. Experts suggest that Maharashtra needs a more streamlined dispute resolution mechanism, improved tax enforcement, and stricter penalties for delayed payments to enhance revenue collection.

Possible Solutions to Improve Revenue Recovery

- Strengthening Tax Administration: The state must improve tax collection efficiency and address loopholes that allow companies to delay payments

- Fast-Tracking Dispute Resolution: Establishing dedicated tax tribunals or mediation mechanisms can help resolve long-pending disputes more swiftly

- Leveraging Technology: Digitising tax records, implementing AI-driven tax audits, and enhancing real-time monitoring can minimise delays and disputes

- Stricter Enforcement of Non-Tax Revenue Collection: Departments responsible for non-tax revenues should be held accountable for timely collections

- Regular Amnesty Schemes with Clear Guidelines: Instead of ad-hoc relief programs, the government can introduce structured amnesty policies that encourage voluntary compliance.

Conclusion

Maharashtra’s economic challenges underscore the importance of efficient tax and revenue collection. With over ₹1.66 lakh crore in pending arrears, the state faces a daunting task in bridging its revenue shortfall while managing a historically high debt burden. The amnesty scheme, while helpful, is not a complete solution. A long-term strategy focused on resolving disputes, improving tax administration, and enhancing non-tax revenue collection is crucial for stabilising the state’s financial health. The success of these measures will determine whether Maharashtra can overcome its current fiscal crisis and sustain growth in the coming years. Consult a tax expert for more detailed tax explanation. Talk to a tax expert from Vakilsearch today.