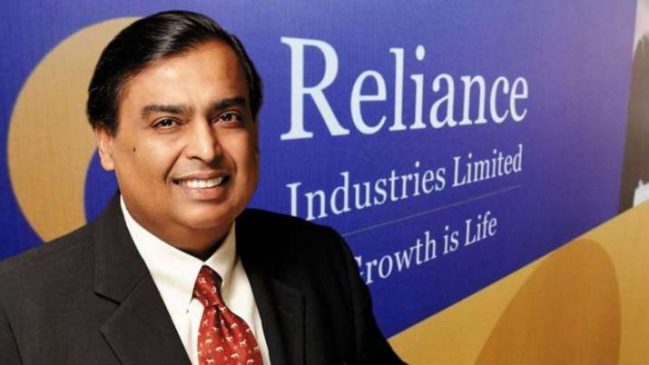

In a significant development, the Securities Appellate Tribunal (SAT) has nullified the Securities and Exchange Board of India’s (Sebi) order imposing a hefty ₹25 crore fine on billionaire Mukesh Ambani and his conglomerate Reliance Industries Ltd (RIL). The penalisation was related to the 2007 Reliance Petroleum Limited (RPL) case, where Sebi alleged manipulation of shares.

Back in 2021, Sebi issued an order penalising Mukesh Ambani, Chairman and Managing Director of RIL, along with two other entities, Navi Mumbai SEZ Pvt Ltd and Mumbai SEZ Ltd. The allegations centred around the purported breach of takeover regulations during the sale of Reliance Petroleum Limited shares in November 2007.

The case, dating back to 2007, revolved around RIL’s decision to sell a 5 percent stake in RPL, a listed subsidiary that later merged with RIL in 2009. Sebi contended that the promoters exceeded the regulated limit of 5 percent by taking over a 6.83 percent stake, valuing ₹12 crores.

Sebi, in its 2021 order, found Mukesh Ambani and RIL guilty of manipulating the takeover of shares and imposed a significant penalty of ₹25 crore. The penalty was extended to Mukesh Ambani’s brother Anil Ambani, their family members, and entities linked to the deal.

However, the recent decision by SAT has brought relief to Mukesh Ambani and RIL. The tribunal asserted that Sebi failed to provide concrete evidence linking Ambani to the alleged contraventions. SAT highlighted the minutes of two RIL board meetings, emphasising that the impugned trades were executed by senior officials without Ambani’s knowledge.

The tribunal explicitly stated, “Given the stark evidence in the form of minutes of the two board meetings of RIL which conclusively proves that the impugned trades were carried out by two senior officials without the knowledge of the appellant, no liability can be fastened upon notice no. 2 (Ambani).”

SAT’s decision to quash the Sebi order underscores the importance of establishing direct involvement and culpability. The tribunal emphasised that Ambani cannot be held responsible for every alleged contravention of the law by corporate entities.

This ruling brings a noteworthy turn to the legal proceedings, offering a reprieve to Mukesh Ambani and Reliance Industries from the substantial financial penalty imposed by Sebi in connection with the 2007 RPL case.

- Vodafone Idea’s Upcoming Fundraising: Aiming to Collect ₹18,000-20,000 Crore - April 11, 2024

- Is the Indian Stock Market Open Today? - April 11, 2024

- Emerging Regional Carriers Aim to Capture Growing Short-Haul Flight Market in India - March 25, 2024