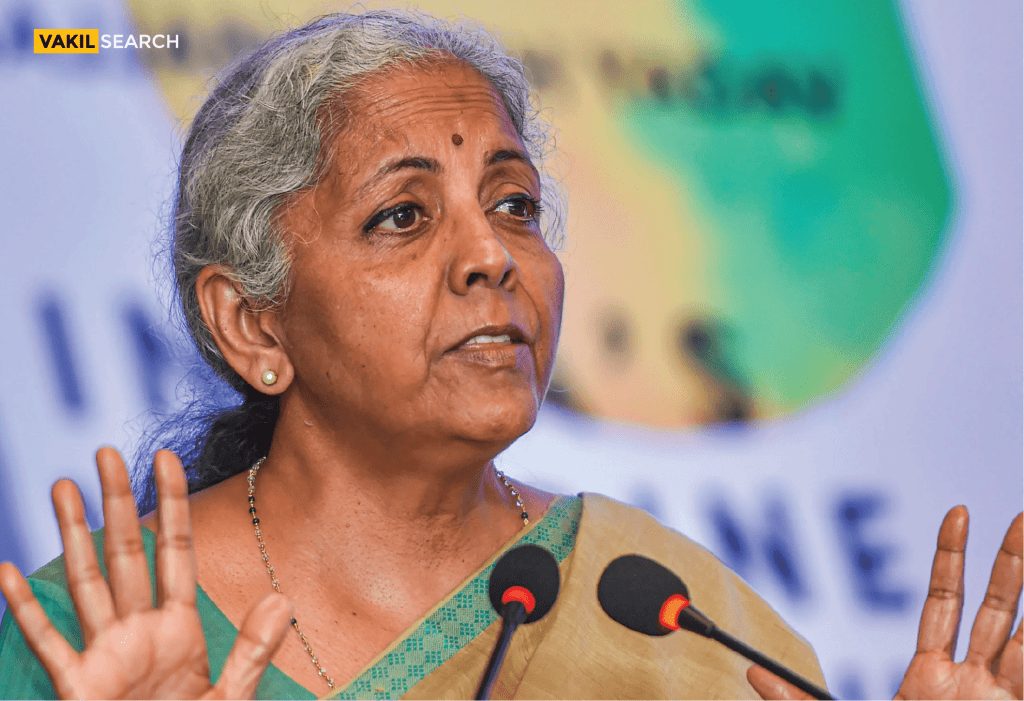

Union Finance Minister Nirmala Sitharaman defended new provisions in the Income Tax Bill, 2025, granting tax authorities access to digital records. She said this measure is essential to curb tax evasion and financial fraud.

Addressing the Lok Sabha on Tuesday, Sitharaman highlighted cases where encrypted WhatsApp messages and digital tools like Google Maps history helped uncover undisclosed income. She stated that such digital evidence exposed ₹200 crore in unaccounted money linked to cryptocurrency transactions.

“Encrypted mobile messages led to the discovery of ₹250 crore in unaccounted wealth. WhatsApp messages provided crucial leads in exposing ₹200 crore in unreported crypto assets. Digital communication has been key in tax investigations,” Sitharaman said, as quoted by MoneyControl.

Access to Digital Records Essential for Tax Investigations

The Finance Minister stressed the need to bring digital records under tax investigations. She explained that the current Income Tax Act of 1961 primarily refers to physical books of accounts, ledgers, and manual records. This limitation hinders tax officials when seeking digital evidence.

“This has led to legal challenges where individuals argue, ‘I have shown my ledger, why do you need my digital records?’ The new Bill addresses this gap,” Sitharaman stated.

She cited multiple cases where digital evidence, including WhatsApp conversations, mobile location data, and online transactions, exposed financial fraud.

- Unaccounted Wealth of ₹250 Crore: Authorities accessed encrypted mobile messages and identified tax evaders.

- Crypto Transactions Worth ₹90 Crore: WhatsApp messages helped track individuals involved in undisclosed cryptocurrency dealings.

- Bogus Billing Scam of ₹200 Crore: Digital communication records led officials to fraudulent syndicates issuing fake invoices.

- Manipulated Capital Gains: Investigators discovered that individuals fraudulently reduced land sale transactions worth ₹150 crore to ₹2 crore using false acquisition cost documents and altered bank records. WhatsApp messages revealed those involved.

- Google Maps for Location Tracking: Authorities used location data to identify secret locations where undeclared cash was stored.

Sitharaman said tax officials struggle to present digital evidence in court without explicit legal provisions. “If the law does not formally recognise digital access, even clear evidence of tax evasion can be challenged,” she explained.

New Powers Under the Income Tax Bill, 2025

The Income Tax Bill, 2025, introduced in the Lok Sabha on 13 February, aims to replace the Income Tax Act of 1961. The Bill retains most existing provisions but simplifies language, removes redundant sections, and aligns tax enforcement with modern financial practices.

A major change in the Bill includes virtual digital assets under undisclosed income. This expands coverage to digital tokens, cryptocurrencies, and other cryptographic assets, according to PRS India.

The Bill also grants tax authorities the power to access virtual digital spaces during search and seizure operations. This includes email servers, social media accounts, and online trading platforms that store asset ownership details. Officials can override access codes to inspect these digital records.

Sitharaman justified the move, stating that tax evaders use digital platforms to hide transactions. “Without access to digital records, tax enforcement cannot keep pace with evolving technology,” she said.

Opposition and Concerns

Despite the government’s stance, opposition leaders raised concerns over privacy and misuse of power. Some critics argued that allowing tax officials access to personal digital records could lead to overreach and privacy violations.

Legal experts suggested safeguards to prevent misuse. They emphasised the need for clear guidelines on how and when digital access applies to tax investigations.

Way Forward

As the Bill progresses in Parliament, discussions on balancing tax enforcement with privacy rights will continue. The government maintains that digital access will be used only for legitimate tax investigations. Legal protections will be in place to prevent abuse.

With tax evasion tactics becoming more sophisticated, the proposed legal amendments aim to close existing loopholes. The final version of the Bill will determine the extent of digital access allowed for tax authorities in the future.

As tax investigations expand into digital records, businesses must ensure compliance with evolving laws. Vakilsearch provides expert tax and legal support to help you stay ahead.

- FM Sitharaman Defends Digital Records Access in Tax Investigations - March 26, 2025

- Govt Launches Incentive Scheme for Small-Value UPI Transactions - March 21, 2025

- Delhi HC Blocks ‘Domindo’s Pizza’ Over Domino’s Trademark Case - March 18, 2025